Current Cash Debt Coverage Ratio Calculator. = $500,000 / $40,000 = 12.5. In contrast to the ccr, the current cdcr points to the income statement.

The solution lies in debt coverage ratio calculation. As an accountant, you should first see the proportion between the net operating income and the debt service cost. Suppose a company generated $55,000 cash from operations during the last year.

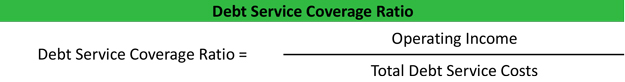

Debt Coverage Ratio Calculator Uses Debt_Coverage_Ratio = Net Operating Income / Debt Service To Calculate The Debt Coverage Ratio, The Debt Coverage Ratio Is A Measure Of The Cash Flow Available To Pay Current Debt Obligations.

Find the average total liabilities. How do you calculate current cash debt coverage ratio? In contrast to the ccr, the current cdcr points to the income statement.

Clearly, You Must Average The Current Liabilities Over That Same Period.

The current liabilities at the beginning and at the end of the year were $45,000 and $60,000 respectively. = $500,000 / $40,000 = 12.5. Asset coverage ratio is calculated using the formula given below

Dscr Formula The Dscr Calculation Formula Is As Follows:

The 20% obtained means that the company will pay off 20% of its outstanding debts in one year. Since the average current liabilities of abc co. Problem b) calculate sherban’s current cash debt coverage ratio, cash debt coverage ratio and free cash flow.

Operating Cash Flow By The Total Debt Of The Business.

You can usually find the cash and cash equivalents information on a balance sheet. As an accountant, you should first see the proportion between the net operating income and the debt service cost. Formula = net operating income / debt service cost.

Cash Debt Coverage Ratio = Net Cash Provided By Operating Activities / Total Debt So Divide The Net Cash Of The Business That Is Provided By Its Operating Activities I.e.

Therefore, if you have a cash debt coverage ratio of 0.2, when divided by 1, the resulting figure is 5, meaning that it would take the company 5 years to repay all its debts. $350,000 ÷ $1,500,000 = 0.23 or 23% a ratio of 23% indicates that it would take the company between four and five years to pay off all its debt, assuming constant cash flows for the next five years. Therefore, current cash debt coverage ratio = 26,250/ 25,000 = 2

Related Posts

- Cot Inverse CalculatorCot Inverse Calculator. Link to this page by copying the following text. Alternatively, if the angle is unknown, but the lengths of the two sides of ...

- Volume Of The Solid Generated By Revolving CalculatorVolume Of The Solid Generated By Revolving Calculator. In the case of a right circular cylinder (soup can), this becomes. Adjust the a and b values b ...

- Expand Log Expressions CalculatorExpand Log Expressions Calculator. Detailed step by step solutions to your logarithmic equations problems online with our math solver and calculator. ...

- Ul To Ml Conversion CalculatorUl To Ml Conversion Calculator. Microliters to milliliters (µl to ml) calculator, conversion table and how to convert how to convert 1 microliter (µl ...

- Cubic Regression Calculator OnlineCubic Regression Calculator Online. Up to 1000 rows of data may be pasted into the table column. Now the quadratic regression equation is as follows: ...

- Gallons To Quarts CalculatorGallons To Quarts Calculator. = 25 x 4 = 100 quarts. Volume_gal:1 is equal to 3.99999697 quarts, which is the conversion factor from gallons to quart ...

- Implicit Differentiation D2Y Dx2 CalculatorImplicit Differentiation D2Y Dx2 Calculator. Fun‑3 (eu) , fun‑3.d (lo) , fun‑3.d.1 (ek) transcript some relationships cannot be represented by an exp ...